Originally published as a featured column in the July/August 2024 Issue of Indoor Comfort Marketing.

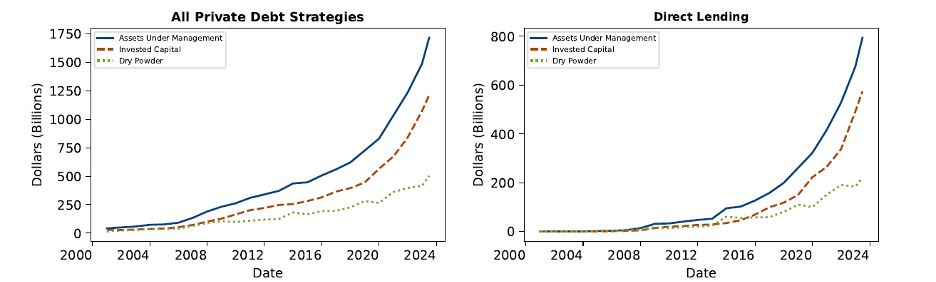

In case you missed it, the capital landscape for small and medium-sized businesses has changed dramatically in recent years. Most notably, the availability of private credit from non-bank providers has grown more than 300% in the last decade. The private equity data specialist Pitchbook has found that assets under management (AUM) are approaching $1.5 trillion worldwide. The vast offerings of private debt providers are pushing down into the lower middle market, where most fuel distribution and HVAC companies reside and long the domain of traditional local and regional banks.

Source: Preqin & Federal Reserve

There are numerous reasons for the surge in equity and debt private capital sources. Still, from a practical standpoint, it makes more sense than ever for business owners to acquaint themselves with private capital providers. This is especially true if your company has achieved (or would achieve via acquisition or other growth initiative) an EBITDA level above $2 million. Common sources of private credit like direct lending and mezzanine (i.e., subordinated) lending are filling the gap where traditional lenders have stepped back in recent years due to increased banking regulation and balance sheet capital requirements, tighter credit standards and higher interest rates.

Acquisition opportunities in a consolidating fuel distribution and HVAC market abound for business owners pursuing growth. However, these opportunities often require significant capital support. Tapping into non-bank equity and debt sources has become a pathway to growth for many reasons. And it will be increasingly important for company leaders to understand why there is more private capital available and how best to leverage the opportunity:

Traditional bank lending has shrunk. According to Reuters, since the end of 2022, bank credit in general has declined 6%, and the issuance of commercial and industrial loans has declined 15%. As a closely regulated entity, a traditional bank’s loans are typically characterized by strict amortization requirements, lending caps based on borrower size and a slow approval process. From a practical standpoint, this means consummating that transformative acquisition or executing a significant growth strategy will likely require additional capital partners.

The economics of doing business require it. Heating and cooling businesses are feeling the stress of ongoing consolidation, challenges with technician and driver retention and future administrative compliance costs associated with impending clean heat standards and similar environmental regulations in certain regions. Achieving efficiency and longevity will increasingly require scale — and scale means growth through acquisition.

Many of your competitors already utilize private capital. Most fuel dealers and HVAC companies compete for customers and talent against large, super-regional companies. Many of these large firms are backed by sophisticated private equity firms supporting their growth. Due to their size and financial backing, these consolidators are skilled in pursuing opportunities in your region with aggressive offers.

You can mix and match it. Where growth strategies are sizeable enough to attract a private capital partner, you can sometimes combine a mix of equity and subordinated debt with traditional bank debt and a revolving line of credit to accommodate the new structure. Often, the same partner will provide multiple forms of capital. Leveraging these various sources of capital can allow company owners to accomplish larger acquisitions that are simply inaccessible for many in the industry through a banking relationship alone.

Record “dry powder” is looking for a home. As noted in the chart above, committed but yet-to-be-invested capital from private investors is approaching $500 billion worldwide. These private capital sources must eventually, but smartly, put this money to work for investors. Good opportunities, a history of stable earnings and quality management teams will attract interest.

Private equity giant Blackrock is projecting private credit sources could more than double over the next five years, continuing to replace a large portion of the debt markets previously served by regulated banks. As this pool of private capital continues to grow, a further push into the lower middle market sector is likely to benefit a growing segment of the heating and cooling industry.

As you come back from your summer vacations and the focus of your business turns from air conditioning to degree days, it’s a good time to take stock of capital needs for today – and potentially for tomorrow. Are you capitalized for growth? Do you have a good understanding of how to leverage the increased capital available to your business? And what banking and capital relationships do you have – or do you need – to be successful next year and beyond?

Whether your opportunity to tap into these sources of growth capital exists today — or might exist tomorrow — gaining an understanding of these markets should be a top priority this year.

Jeff Simpson is the founder and managing member of Notch Capital, a private investment firm specializing in buyouts and recapitalizations of lower middle market businesses in the heating, cooling and home services industries. Notch Capital also provides advisory services to help these businesses strengthen their performance and analyze acquisitions.